|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploring the Pinnacle of Mortgage CRM SoftwareIn the ever-evolving landscape of real estate and financial technology, mortgage professionals constantly seek tools that enhance efficiency, improve client relationships, and streamline complex processes. Among these tools, Mortgage CRM Software stands out as a quintessential asset for brokers and lenders alike. What makes a CRM system exceptional in this niche? Let’s delve into the intricacies of top mortgage CRM software, exploring how it functions, its benefits, and what to consider when choosing the right one for your business. At its core, a Mortgage CRM (Customer Relationship Management) system is designed to help professionals manage client interactions, automate marketing efforts, and nurture leads through the mortgage process. A robust CRM does more than just store client information; it acts as a comprehensive hub for communication, ensuring every client feels valued and informed. The best systems integrate seamlessly with other tools, offering features like email marketing, lead tracking, and analytics that provide actionable insights. One of the standout features of leading mortgage CRM software is its automation capabilities. By automating routine tasks such as follow-up emails, appointment scheduling, and document requests, these systems free up valuable time for mortgage professionals to focus on what truly matters-building relationships and closing deals. Furthermore, personalization within these platforms ensures that communications are tailored to each client's unique situation, enhancing the overall customer experience. When evaluating different CRM options, consider their integration capabilities. A top-tier CRM should effortlessly integrate with other software systems such as loan origination systems (LOS), accounting software, and marketing platforms. This integration ensures that data flows smoothly between systems, reducing manual data entry errors and providing a holistic view of the customer journey. Moreover, the user interface of a CRM is crucial. A clean, intuitive design can significantly impact user adoption rates and productivity. The best CRMs provide dashboards that are not only aesthetically pleasing but also customizable, allowing users to tailor their workspace to fit their workflow. This flexibility can lead to increased efficiency and satisfaction among team members.

In conclusion, choosing the right mortgage CRM software requires careful consideration of various factors, from automation and integration to security and scalability. While the plethora of options available can seem overwhelming, identifying your business's specific needs and objectives will guide you towards a solution that enhances your operations and client relationships. Remember, the ultimate goal of any CRM is to make your life easier, your work more efficient, and your clients happier. As technology continues to advance, mortgage CRM software will undoubtedly evolve, offering even more sophisticated tools to meet the demands of this dynamic industry. https://monday.com/blog/crm-and-sales/mortgage-crm/

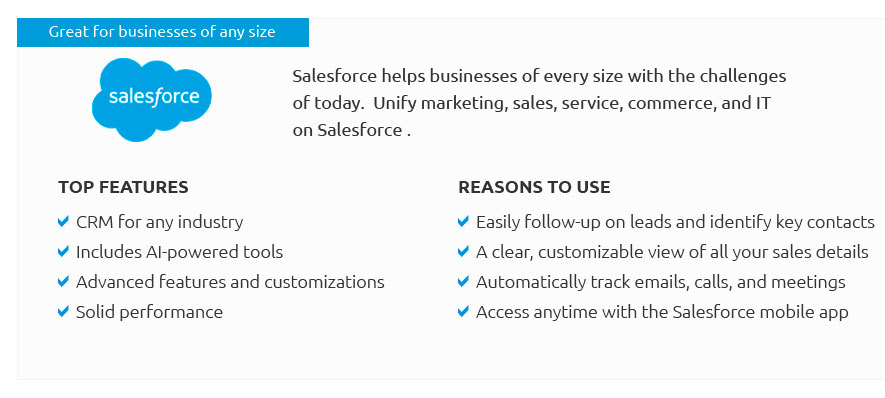

A mortgage customer relationship management (CRM) platform helps organizations keep track of all the leads and borrowers in their pipeline. https://www.salesforce.com/financial-services/mortgage-software/

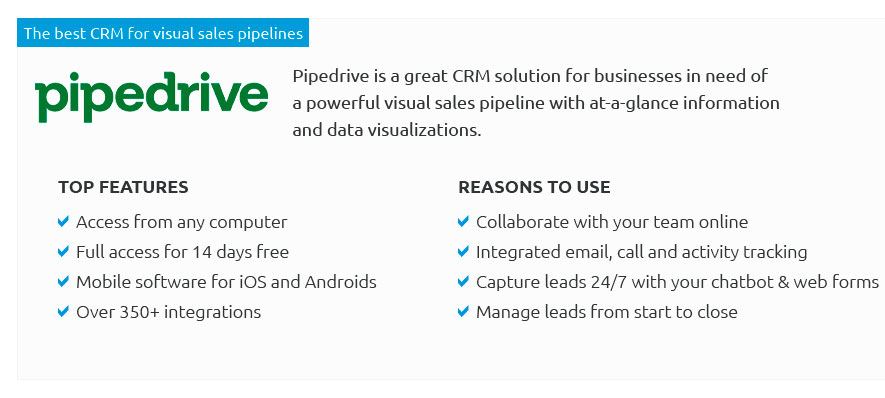

Salesforce is used by mortgage banks, traditional banks, credit unions, non-bank lenders, and other lenders for loan pipeline management, onboarding, borrower ... https://www.pipedrive.com/en/blog/mortgage-crm

The best customer relationship management tools for mortgage processes depend on your business type, team size, budget and unique requirements.

|